For savvy buyers wanting to seize opportunities in a softened market, a temporary rate buy-down is an increasingly popular strategy.

Inflation is currently running at 40 year highs and the Fed is committed to continuing to raise its benchmark Fed Funds rate in an attempt to cool the economy and bring inflation back down. In the near term, there will likely be continued volatility and mortgage rates may get worse before they get better. Longer term, it is still widely anticipated that once inflation starts to come back down, mortgage rates will move lower as well and there will be an opportunity for buyers who have purchased in the last few months to refinance to lower rates.

For buyers, there is an opportunity to buy a home with less competition, possibly pay less for the home which means less down payment, less closing costs and a lower loan amount. And when that refinance opportunity does come, buyers can refinance into a lower interest rate and at a lower loan amount than they would have if they purchased a few months ago. Date the rate and marry the house!

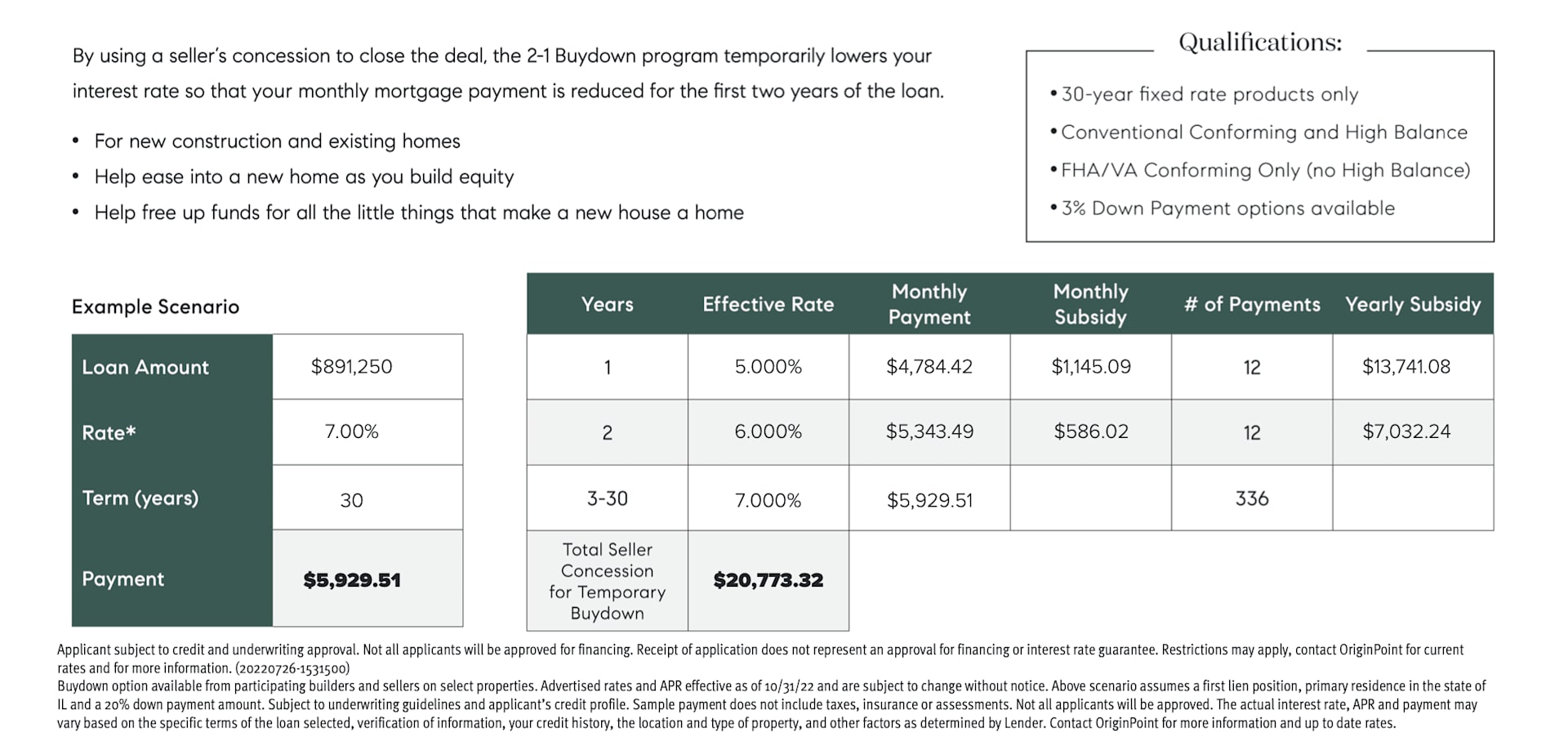

Here's how the 2/1 rate buydown works:

A seller credit at closing can be used to finance either a permanent rate buy down or a temporary rate buy down. On a permanent buydown, the seller pays “points” to lower the buyers interest rate for the life of the loan. On a temporary buy down, the seller pays down a portion of the buyer’s interest rate for a period of time. Typically they buy the rate down 2% year one, 1% year two and then loan returns to the regular note rate in year 3 for the remainder of the loan.

Temporary buy downs are particularly popular as they lower a buyer’s mortgage payment significantly in the first two years of owning the home. If inflation and mortgage rates come down over the next 12 to 24 months, the homeowner can likely refinance to a lower rate. In the meantime, they had the benefit of paying less interest and have a much lower monthly payment. For example, if the note rate for a particular loan is 6.5%, with a 2-1 Buy Down the rate would be 4.5% year one, 5.5% year two before increasing to 6.5% for year three and beyond. Unlike a permanent rate buydown, if the buyer refinances within the first two years, any left over seller credit is applied as a principle reduction to the mortgage and is not lost.

2/1 Buydown Example Scenario

Contact myself or Lysa Griffith at Origin Point for more information:

Lysa Griffith

206.963.0191

www.TeamLysa.com

4040 Lake Washington Blvd NE,

Kirkland WA 98033